Of course, there is also additional time, hassle, and expense associated with corporation formation, maintenance, and tax returns that should be taken into consideration with this decision. In reality, it is less than that, since $1,450 of that tax is deductible to the business. Most doctors are going to max out their Social Security and unemployment taxes anyway if they are paying themselves a salary the IRS will consider reasonable, but there are potential tax savings available due to the Medicare tax.įor example, if a doctor forms an S corp and pays herself a salary of $200,000 and distributions of $100,000, she will save 2.9% in Medicare tax on that last $100,000, or $2,900. Distributions are not subject to payroll taxes such as Social Security tax, unemployment tax, and Medicare tax. However, the savings comes in on the distributions. Salary is taxed just like it is for any W-2 employee and since the owner must pay both the employer half and the employee half of the payroll taxes, you will end up paying an equivalent amount of tax on W-2 salary issued by your S Corp as on sole proprietor income. This allows the owners to split the income from the business into salary and distributions. However, if an LLC or a corporation is formed AND chooses to make an “S election” it will then be considered an S Corporation by the IRS. Understanding Your Tax Return: Income Flowsįorming a partnership or an LLC doesn't reduce your taxes at all.

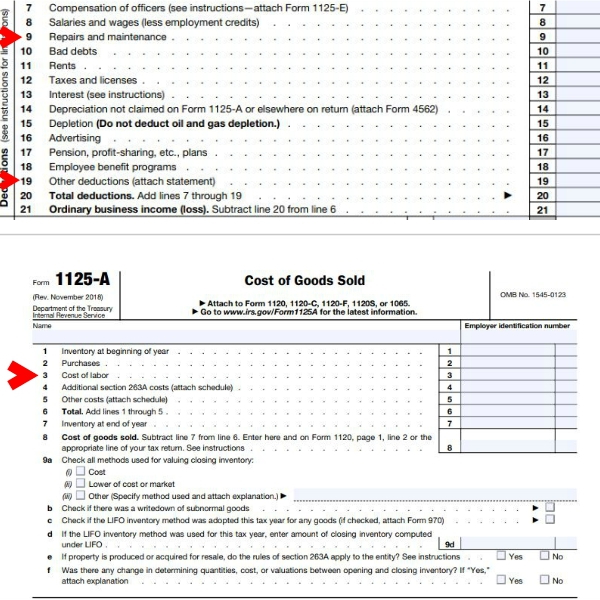

If you're getting a 1099, you're in business. There is also no such thing as a “1099 employee”. Most of the time, you are issued 1099 forms and you pay taxes via the 1040. You don't “pay taxes” through a 1099 form.LLCs are taxed either as a sole proprietor, as a partnership, or as a corporation (C or S). Similarly, income paid to a corporation goes on to the corporate return ( 1120 for a C Corp or a 1120S), which issues W-2s to its employees and K-1s (for an S Corp) or 1099-Divs (for a C Corp) to its owners.The partnership issues the partner a Schedule K-1 which then flows onto the 1040. For a partner, these 1099 forms flow onto Schedule K of a partnership return ( 1065).For a sole proprietor, these 1099 forms (along with all the business expenses) flow onto Schedule C and then on to the 1040.An independent contractor fills out a W-9 for their client.An independent contractor is self-employed and receives 1099 forms from each client they did work for during the year.An employee fills out a W-4 for their employer.That information flows directly onto the 1040 tax form.

0 kommentar(er)

0 kommentar(er)